To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review Bank of America Online Privacy Notice and our Online Privacy FAQs.

#Us mortgage calculator with pmi how to

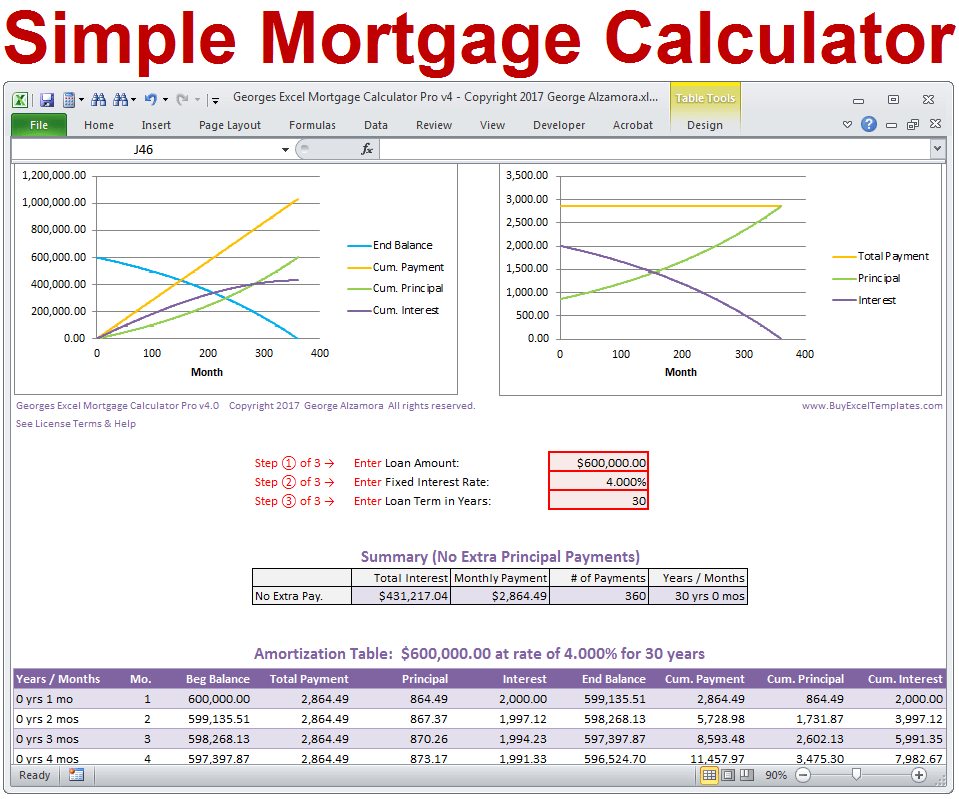

Learn how PMI is used and how to avoid paying for it. These ads are based on your specific account relationships with us. Private mortgage insurance (PMI) is often required for conventional mortgages with less than a 20 down payment. In addition, financial advisors/Client Managers may continue to use information collected online to provide product and service information in accordance with account agreements.Īlso, if you opt out of online behavioral advertising, you may still see ads when you log in to your account, for example through Online Banking or MyMerrill. If you opt out, though, you may still receive generic advertising. The United States Department of Agriculture backs USDA loans that benefit. If you prefer that we do not use this information, you may opt out of online behavioral advertising. You wont pay PMI, but VA loans do require a funding fee. Loan Type Calculator: Match with the Best Loan Type for You Conventional Loan Calculator FHA Mortgage Calculator VA Mortgage Loan Calculator USDA Loan Calculator Jumbo. If you pay less than 20, lenders will expect you to pay PMI as part of your mortgage payment each month. To avoid paying private mortgage insurance (PMI) on a conventional loan, lenders expect a down payment of at least 20. Mortgage Calculator with PMI, Taxes & Insurance Use our mortgage calculator to find home loan options that work for you. Estimate your mortgage payment, including the principal and interest, taxes, insurance, HOA, and PMI.

#Us mortgage calculator with pmi Offline

This information may be used to deliver advertising on our Sites and offline (for example, by phone, email and direct mail) that's customized to meet specific interests you may have. This Private Mortgage Insurance (PMI) calculator reveals monthly PMI costs, the date the PMI policy will cancel and produces an amortization schedule for. A down payment is a percentage of the entire loan amount you pay upfront before closing on the mortgage.

Here's how it works: We gather information about your online activities, such as the searches you conduct on our Sites and the pages you visit.

Relationship-based ads and online behavioral advertising help us do that. At those rates, PMI on a 300,000 mortgage would cost 1,740 to 5,580 per year, or. We strive to provide you with information about products and services you might find interesting and useful. The calculator estimates how much you'll pay for PMI, which can help you determine how much home you can afford.

0 kommentar(er)

0 kommentar(er)